The Accurate Reloading Forums

The Accurate Reloading Forums  THE ACCURATE RELOADING.COM FORUMS

THE ACCURATE RELOADING.COM FORUMS  Guns, Politics, Gunsmithing & Reloading

Guns, Politics, Gunsmithing & Reloading  The Political Forum

The Political Forum  The Redneck Recession . . . starting to hit rural and industrial states

The Redneck Recession . . . starting to hit rural and industrial statesGo  | New  | Find  | Notify  | Tools  | Reply  |  |

| One of Us |

. . . I thought these were Trump's peeps? A potentially K-shaped economy creates dilemmas for the Fed Opinion: A potentially K-shaped economy creates dilemmas for the Fed Opinion by Vivekanand Jayakumar The Hill A K-shaped economy — one branch of which goes up, the other down — appears to best epitomize the economic reality faced by many Americans this year. It is in many ways a tale of two economies. Even as some segments of the population are holding up well, others are facing a recession-type environment. Geographically, there now appears to be a notable divergence. According to economist Mark Zandi, around 21 states (mainly rural and industrial ones) and the Washington, D.C. area are currently either in a recession or close to entering one. Higher income and more experienced workers with relative job security, equity-rich homeowners with paid-off homes or low-rate mortgages, and baby boomers with growing nest eggs are propping up consumer spending. The top 10 percent of households by income are now responsible for about 50 percent of aggregate consumption expenditure. Private sector investment is currently dominated by AI hyperscalers (such as Amazon, Google, Meta and Microsoft), who are aggressively pouring vast amounts into data centers. Outside of the AI-related sectors, business investment has been hurt by tariff-related uncertainties. Corporate earnings have held up so far as companies focus on cost-cutting and efficiency measures. Meanwhile, new entrants (particularly, fresh college graduates) are facing a brutal job market as entry-level positions dry up. The AI revolution appears to be adversely affecting job prospects for young Americans, even as it offers the promise of an overall productivity boost. Low- and middle-income households are struggling to make ends meet and are feeling squeezed from all sides. Persistently elevated inflation rates, made worse by the growing burden of tariffs, hurts lower income households the most. Low- and middle-income households are also unlikely to benefit much from the “One Big Beautiful Bill.” As economist Kimberly Clausing recently highlighted, “The combination of income tax cuts and tariff increases is a regressive fiscal switch that moves the tax burden down the income distribution, away from the well-off and towards poorer members of society.” Gen Z and millennials continue to encounter housing affordability issues. According to a recent Redfin survey, struggling young renters are forgoing eating out and skipping meals to afford rent. Given these developments, the Fed faces a tricky trade-off as the labor market cools while inflation remains above target. The Fed operates under a dual mandate. It is expected to foster conditions that lead to maximum employment (typically interpreted as the lowest level of unemployment that doesn’t accelerate inflation) while maintaining price stability (the Fed adopted an explicit 2 percent inflation target in 2012). Determining whether labor market conditions are deteriorating significantly is proving to be a difficult task. The “low-hire, low-fire” labor market has kept the U.S. unemployment rate under 4.4 percent so far, which is still within the estimated range for the natural rate of unemployment. Furthermore, a slowdown in population growth implies a decline in the breakeven rate of monthly payroll growth (the number of net new jobs the economy needs to add each month to keep the unemployment rate stable). After experiencing a dramatic and controversial surge during the 2022-2024 period, the U.S. has seen a sharp reversal in net migration this year. In this environment, even ultra-low payroll job growth numbers may not necessarily imply poor labor market conditions. Meanwhile, demand for labor appears to be cooling fast as there are now more job seekers than job openings. The AI revolution is leading to loss of certain types of white-collar jobs, especially at the entry-level. Additionally, economic uncertainty associated with the Trump administration’s capricious tariff policies have caused firms to delay or avoid fresh hiring. The labor market has become much less dynamic as both hiring and quit rates have fallen. Ominously, inflationary pressures have started to reemerge. So far, business have been willing to eat much of the extra cost associated with the Trump tariffs. However, as it becomes clear that elevated levels of tariffs are here to stay, most companies are expected to pass on the additional costs to final consumers. So, what should the Fed do? Modern central bankers have been taught to respond asymmetrically to shocks. As a recent Bank for International Settlements report confirms, they typically respond aggressively to demand shocks but act cautiously when faced with supply shocks. If inflation stems primarily from demand factors, mainstream monetary theory recommends a strong central bank response aimed at stabilizing both inflation and output (and employment). However, if inflation is primarily being driven by supply factors, then the theory suggests that the central bank partly “look through” price pressures if inflation expectations remain firmly anchored. Monetary policy actions can have significant distributional consequences as well. A recent New York Fed study found that “stabilizing consumption and inflation go hand in hand for the rich, who are particularly exposed to demand-driven fluctuations in profits, which are highly procyclical. For the poor, in contrast, aggressively stabilizing inflation has a severe cost in terms of higher consumption volatility. While they dislike inflation because it erodes real wages, they are hurt even more by an aggressive monetary policy response to supply shocks, which reduce real wages further while increasing unemployment and real interest rates.” Given the balance of risks, the Fed will likely cut rates by 50 or 75 basis points before the end of 2025. However, it needs to balance short-run pressing demands with potential long-term threats to its credibility. Raising the estimate for the long-run neutral policy rate to 3.75 or 4.00 percent and avoiding dovish rate-cut projections for 2026 will effectively signal to markets that policy will not become ultra-loose anytime soon. Mike | ||

|

| One of Us |

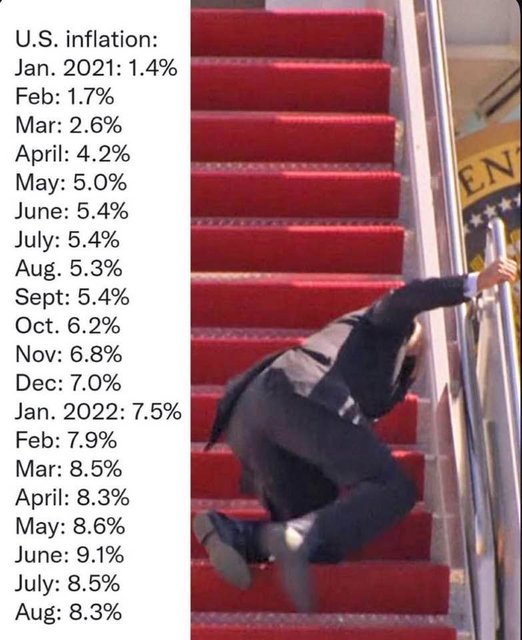

Where was your outrage for this? ~Ann  | |||

|

| Moderator |

Ann, you need to go pick some apples, !!!! if you have enough time to waste by throwing facts at jines opinions vary band of bubbas and STC hunting Club Words aren't Murder - Political assassination is MURDER Information on Ammoguide about the416AR, 458AR, 470AR, 500AR What is an AR round? Case Drawings 416-458-470AR and 500AR. 476AR, http://www.weaponsmith.com | |||

|

| Powered by Social Strata |

| Please Wait. Your request is being processed... |

|

The Accurate Reloading Forums

The Accurate Reloading Forums  THE ACCURATE RELOADING.COM FORUMS

THE ACCURATE RELOADING.COM FORUMS  Guns, Politics, Gunsmithing & Reloading

Guns, Politics, Gunsmithing & Reloading  The Political Forum

The Political Forum  The Redneck Recession . . . starting to hit rural and industrial states

The Redneck Recession . . . starting to hit rural and industrial states

Visit our on-line store for AR Memorabilia