The Accurate Reloading Forums

The Accurate Reloading Forums  THE ACCURATE RELOADING.COM FORUMS

THE ACCURATE RELOADING.COM FORUMS  Other Topics

Other Topics  Miscellaneous Topics

Miscellaneous Topics  Glad we live in a flawed American Democracy

Glad we live in a flawed American DemocracyGo  | New  | Find  | Notify  | Tools  | Reply  |  |

| One of Us |

Seeing the joke that has become Greece. I am glad I live in a country with a truly flawed democratic system but a great republic. I will take an electoral college, states rights, 2 party monopoly, senate, house and a Supreme Court that makes up policy issues and a fed that might need to be audited over the joke of putting critical national survival issues to a referendum. Feel really bad for the Greek people but you really don't want to push the Germans beyond a point. Once Spain Italy Portugal and Ireland sees what Greece goes thru - they will never deviate from the party line. Mike | ||

|

| one of us |

I've done a lot of work in Greece and had some great customers there, but their political system is hopeless | |||

|

| One of Us |

The two marxist jokers currently running it and the stupidest retards in the world. Alexis Tsipras and Yanis Varoufakis (this retard actually taught as a visiting professor at UT !!!) This is going to end ugly for Greece and great for the rest of the capitalist world (we who own public equities) Playing a stupid game of chicken with Germany and France. I hope they default, have massive riots and social unrest and devalue the new currency. This has to be brutal to scare every other retard socialist and communist in Spain Portugal and Italy this is what waits financial and fiscal idiots. Mike | |||

|

| One of Us |

socialism can be a wonderful thing, as long as you stick to teaching it to 18 year olds at liberal arts colleges. Reality; that seems to be quite a different situation. It works until you run out of other people's money... | |||

|

| One of Us |

Thank you Winston. Never mistake motion for action. | |||

|

| One of Us |

The worst case is kicking the can down the road. Either exit the euro or the creditors have to reduce the debt. If you kick the can down the road it will come back to bite at twice the size. The Greek politicians are a bunch of scoundrels - lowlifes that are playing a very stupid game. The are dangerous cause they think they are smart. I am tired of all this crap about poor people in Greece. The whole pension ssystem was massively bloated - a hairdresser was considered a dangerous occupation entitled to retire at 50 w/ pension. This creeping growth of socialism disguised in equitable terms is financial and fiscal death. Why I admired Singapore and Hong Kong so much - bastions of capitalism. Mike | |||

|

| One of Us |

'States rights'? Since when? Where in the Constitution is the Supreme Court allowed to make policy? The Fed 'might' need an audit? What country do you actually live in? | |||

|

| One of Us |

Damn it, Mike, isn Tsipras and Yanis Varoufakis has driven the Greek economy into this hellhole? I understand that many don't like Marx (let will not shorten his beard) but must be honest at least with yourself. | |||

|

| One of Us |

Problem is, unless we reverse course, we will be living in Greece in a decade or two. ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

http://www.nytimes.com/2015/06...-on-greece.html?_r=0 The nytimes lays out the greece as whipping boy example for other socialist. What the greeks are going down is something crazy and scary as hell. Leaving a currency for a new one has never been done - this is a lot more than devaluation. I think greeks need to understand what they are choosing - their politicans are worthless scumbags. In the us i prefer a divided executive and legislative. Mike | |||

|

| One of Us |

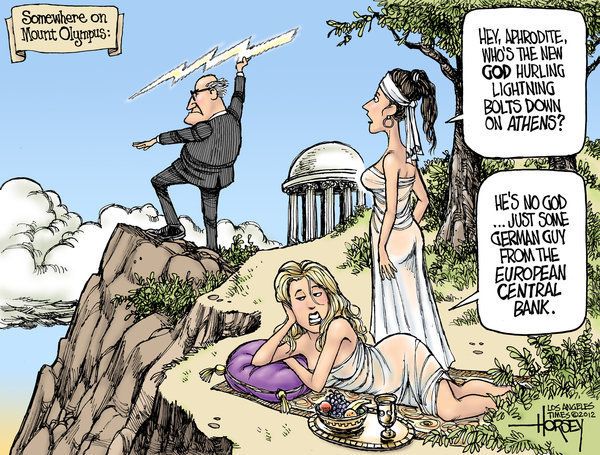

| |||

|

| One of Us |

When you constantly spend more than you take in and there are fewer and fewer producers and more and more takers, you wind up with Greece. The US government is taking in record tax revenues and is still sending far more money than it is taking in. Half of Americans are on some form of government assistance and only a third are working and paying taxes. As it stands today, we are $18.2 trillion in debt with a GDP of $17.7 trillion. We are well on the path to becoming Greece and no one in Washington is talking about a Balanced Budge Amendment and getting Americans back into the workforce. We are running out of road to kick the can much further. ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

I haven't the banking business and can't understand how it was possible to give money to someone who obviously will not be able to give under any circumstances. Or just bankers are not too smart and become rich just because happened to be at the right time in the right place? The history of Greece clearly shows that bankers are not able to control the economy. | |||

|

| One of Us |

Unfortunately that is exactly what happened with our housing crisis. Our banks were forced to offer subprime home loans to people who could not possibly pay them back. Thus, the housing crisis. But it is pretty amazing that the IMF was silly enough to bail out Greece. No one in the country works anymore to pay taxes and any money that the government has is immediately handed out to the non-workers. Pretty much a recipe for disaster. ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

"were forced" - by whom? I was under the impression that the EU has long wanted to shut this down, but wanted to do it, when to power there will come the euroskeptics. They say "Marxists are to blame for everything". Marxists, may be to blame, but not in this case. The Greeks are in debt as in silk, and not only at the state level. I was in Greece a few years ago, talking with a female taxi driver: "why are there so many cars?". "And it's all on credit". "What will you give?". "The performance of our courts for recovery of loans - several thousand a year, and the debtors are millions. All hope that they will not come soon." And main thing: some branches of industry were forbidden in Greece by EU! | |||

|

| One of Us |

| |||

|

| One of Us |

Yes, in fact it is a socialist measure. The fed offers to the owners of the banks to share the money with the poor | |||

|

| One of Us |

Deregulating the banks caused the S&L crash and the last housing, derivatives crash. Funny the banks wanted in on the market and the Brokers wanted in on the banking. Well guess what, they got both. I remember one day we had 200 employees at the FHLB in NY, then one day we had 800 when the regulators were dumped into the firm. Then along comes the money washers in the form of the RTC. We then lost 600 employees in one day. The RTC maked Berney look like a piker.

| |||

|

| One of Us |

Actually the crash occurred because there was an artificial rise in the number of new homeowners competing for a fixed number of homes. It was too easy for undisciplined, incompetent folks to be approved for a sub prime loans due to existing banking regulations. This allowed pretty much anyone to qualify and enter the housing market. With so many new potential homeowners entering the market, demand was greater than supply and housing prices rose at a dramatic/ridiculous pace. Again, all artificial because many of the new homeowners couldn't possibly afford their home, but that was OK because housing prices were rising so fast. When the market topped out, and prices started to fall, homeowners panicked and the defaults started. From the banking point of view, toxic subprime paper was part of doing business and could be wrapped with prime loans. And all was well and good as long as property values continued to rise, thus the asset was valuable. When the music stopped, the paper was worthless and the house of cards fell apart. Derivatives did not cause the housing crisis. Defaulting on loans and massive deflation of property values is what caused the collapse. ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

The french and german banks have no more exposure. It has all been taken by the ESF and ECB. So a default and kicking out of Greece has no impact on the Western European Banking system. ECB is already buying bonds - writing of greece debt is not the end of the world. Greece is an irrelevant country and its debt is $400 bil. It does not really matter in the global economy as long as there is no contagion to Spain or Italy. Bond those country bonds are trading in line with US government bonds. I think German wants to make an example of Greece - show how painful it is to leave the euro. Scare the daylights out of other socialist. Maybe Russia steps in to rescue greece or provide advice as it has defaulted in 1998. I doubt Putin has any desires to save the Greeks. Scary for Greece to go from 1st world to 4th world in such a short time. Marxist idiot scumbag politicians suck. So much for the cradle of Western Civilization. Capital and efficient resource allocation in the end dominate. Mike | |||

|

| One of Us |

WSJ reports Greek banks have under 1 bil. euros in cash remaining. 11 mil. people - 60 euro a day max with drawl. Doubt the banks are solvent for more than 2-3 days to even operate under capital controls. I would not want to be visiting or vacationing in Greece right now. Mike | |||

|

| One of Us |

It's all true but all secondary to the problem.

| |||

|

| One of Us |

But I vote for derivatives^ http://www.usnews.com/opinion/...the-financial-crisis | |||

|

| One of Us |

Ummmm vashper, as the article you posted pointed out the repeal Glass-Steagall allowed banks to make subprime loans possible. Thus, the beginning of loans to borrowers who could not possibly pay back their loans. Furthermore, the repeal of G-S allowed the banks to stop the practice of using insured depositories to underwrite loans. The derivatives market is massively larger today than it was during the financial crisis. If derivatives were so bad and caused the crash, why are we not seeing crash after crash in that market??? Derivatives did not cause the crash, bad loans to irresponsible borrowers is what caused the crash. The resulting bad paper only magnified the effect. But as always, please believe whatever you wish. ___________________ Just Remember, We ALL Told You So. | |||

|

| one of us |

Lots of people point to the repeal of Glass Steagle as a factor in the collapse. I disagree. Lehman Bros and Bear Stearns were pure investment banks, The GSEs and AIG were not covered by Glass Steagle. Only one tangental player, Citibank, was effected by the repeal. | |||

|

| One of Us |

Very true. Lehman was busy trading toxic paper and making money doing it. Of course there wouldn't have been any toxic paper had borrowers been solvent and responsible. And of course there wouldn't have been any irresponsible borrows had the lending standards been maintained. But the "Everyone Deserves A House" crowd did everything in their power to ensure the irresponsible could play too. Defaults caused the crash. ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

https://en.wikipedia.org/wiki/...e_asset_price_bubble In my opinion, the mechanism of the crisis in a way similar to the famous card game, in Russian "believe it or not believe, or trast-not trast", in English is something out there with "bullshit". But all crises have a common cause - a risky loan and generally consumer credit, which kills future demand (Marx wrote But there are also mechanisms that contribute to the severity of the crises. Because for some reason the law - Glass-Steagall was accepted in his time, not only for congressmen to take that they do not . | |||

|

| One of Us |

| |||

|

| One of Us |

Strikes me that we need another T.R. or a Ronald Reagan for modern times. Never mistake motion for action. | |||

|

| one of us |

Patience, Opus. The velocity of money will have to be truly astonishing for the derivatives to be covered next time. TomP Our country, right or wrong. When right, to be kept right, when wrong to be put right. Carl Schurz (1829 - 1906) | |||

|

| One of Us |

Thomas Jefferson (iirc) is quoted as saying that "the United States has the second worst form of government in the world. Fortunately, all others are tied for first...". | |||

|

| One of Us |

Greece a worthless irrelevant country - main export refined petroleum (they have a refinery ya), fresh fish and cotton (some of AR civil war buffs may get all excited). Time for Germany to set it straight and put the fear of god and germany and a good banking crisis in every marxist socialist political scumbag politician. Mike | |||

|

| One of Us |

I totally agree. We are living in a credit system that the federal reserve cannot fix. They have lowered interest rates as far as they can and people continue to borrow as much as they can, and still the economy has not improved enough to start raising those interest rates. The people of our country continue to demand goods and services from a government that is trillions of dollars in debt. How long is that going to last? | |||

|

| One of Us |

Greek voters want free money and free pensions - and damn it they will get it thru the ballot box !!! Reminds me of someone offering free cell phones. Germany needs to decide does a democratic election triumph over fiscal and economic reality. Time to kick Greece out of the euro and simply monitize the debt as part of ecb qe policy. http://www.nytimes.com/2015/07...?_r=0&abt=0002&abg=1 I hate populist ballots - democracy is often mob rule especially in the age of social media. Mike | |||

|

| One of Us |

Oh on + off the subject. I got this from The National Revue .Look at your phone bill. Amonnst all those other weird charges are the ones 'Universal charge + state universal charge.' What those are is you are paying for welfare recipients to get a free celphone. In the article (Twanda Jackson)says,I just gets me a new one every time I goes down to get my entitelments......I'm pissed,are you? Never mistake motion for action. | |||

|

| One of Us |

I don't understand bird language. The situation is really simple, like a cow mooing. 4 premiere Greece (all with University degrees from the best universities of the West, two from Harvard) had accumulated so much debt that Greece, under any circumstances, will not be able to give them - it just doesn't produce as much product to sell on the world market. And the fifth Prime Minister, whether he is a Marxist, a fascist, or a Republican (by the way, has the GOP a good economists?) - to do anything about it. This is the same problem as Kensco with the beavers. | |||

|

| One of Us |

Maybe take a lesson from Russian in 1998 and just default. Something about a sovereign not paying ones debt must be embarrassing to some Russians or living in a country where median household wealth is $841 - india a third world country has higher median household wealth and a lot more households. Maybe Putin can help this fellow jokers in Greece Mike | |||

|

| One of Us |

Yep! Germany told Greece today to pound sand and tomorrow is an EU meeting. Hopefully they demonstrate a little fortitude and kick the children out of the EU. Next, we need to deal with our children... ___________________ Just Remember, We ALL Told You So. | |||

|

| One of Us |

Yes, but only have to do this at least 8 years ago. It must have been uncomfortable due to ideological proximity to the EU and the rulers of Greece. The EU then had to organize a Marxist coup in Athens and then with a calm mind to exclude Greece. Technology coups well-known, I could even recommend good organizers personally, they often appear in the political branch. Yes, and where does Russia in this deal with Greece? She does not and, moreover, its economy has been torn to shreds | |||

|

| One of Us |

??? Actually shower GDP in Russia more Indian 10 times, even according to the CIA Factbook. Although for us Hindus don't seem to be subhuman, and comparing them doesn't seem shameful. | |||

|

| Powered by Social Strata | Page 1 2 |

| Please Wait. Your request is being processed... |

|

The Accurate Reloading Forums

The Accurate Reloading Forums  THE ACCURATE RELOADING.COM FORUMS

THE ACCURATE RELOADING.COM FORUMS  Other Topics

Other Topics  Miscellaneous Topics

Miscellaneous Topics  Glad we live in a flawed American Democracy

Glad we live in a flawed American Democracy

Visit our on-line store for AR Memorabilia